Financing old cars

Buying an older car has its advantages, and the purchase process is relatively easy. As simple as it is, however, it's not unusual for drivers to have questions, especially when it comes to financing. In fact, one of the most common inquiries drivers have about buying a pre-owned vehicle is, "can you finance a car older than 10 years?"

If you've found yourself asking this question during your used car search, the answer is yes—you can finance a car older than 10 years! Here's how.

Financing a car over 10 years old is quite simple. All you need to do is apply for the loan and work out the details with the seller once you're approved.

The average vehicle on the road today is about 11 years old. With that number only expected to increase, more banks and lenders are making it easy to finance an old car. Most lending institutions will look at the following before considering a loan on a 10-year-old car:

- Overall mileage

- The amount being financed must be at least $5,000

- Your credit score.

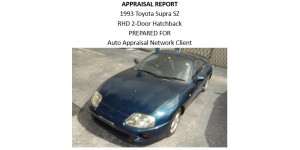

- A current Fair Market, or Actual Cash Value appraisal of the vehicle

A Fair Market Value appraisal from an independent auto appraiser reassures the lending institution of the actual cash value of the vehicle rather than the selling price that the seller and buyer have agreed to, which might be inflated.

There are some banks out there willing to provide a loan for a 10-year-old car, but credit unions seem to be preferable if you’re looking for financing options on an older vehicle. It is usually easier to get pre-approved with a credit union and with more and more emerging, chances are good that you’ll be able to find one where you’ll be eligible for membership.

Financing a vehicle that's over a decade old is easy, but there are still aspects you should consider. That way, you can be thoroughly prepared when you're ready to apply and buy your next used car.

The age of a vehicle isn't always the most significant factor when it comes to financing a used car. While it does play a role in determining what terms may be available for you, lenders tend to put more weight on the person applying for a loan and their credit score.

Your credit score is a measure of your credit worthiness. Generally, it ranges from 300 to 850. Your score lets lenders evaluate the probability that you will repay your loan in a timely manner. It takes the following factors into account:

- Number of open accounts

- Total levels of debt

- Repayment history

Typically, those with higher scores are approved for more financing offers. However, it is possible to get financing even with bad or no credit—especially when working with a well-connected dealership. Financing a cheap used car could also be a step towards boosting your score, so you can make financing a vehicle even easier in the future.

You might need to get a co-signer when looking to finance an older car. It all depends on your individual credit score. A lender cannot require a co-signer if you qualify on your own but getting one could possibly lower the interest payments and get you more options.

A co-signer is usually a parent, spouse, or friend who will be obligated to pay back the loan just as you are. Finding one with a great credit score is beneficial for both the lender and the borrower and could be a big help in the long run.

Finding the right financing for older pre-owned vehicles can take time, depending on a few factors. Having a down payment can make it easier to get approved for a loan, regardless of the age of the car.

Making a deposit can reduce the amount you'd need to borrow from lenders. The less money you'll need to borrow, the more likely you'll be approved for a loan.

For a Fair Market Value auto appraisal for financing, call/text: 786-853-0711

Tags

All blog car appraisal cars tires Auto insurance Safer driving Divorce appraisals Car consultant DiminishedValue Diminished Value VIN Vehicle Identification Number Collector Cars Appraisal Clause Pre purchase inspections Vehicle Inspections Charitable Donation Total loss Prior to loss Totaled car Wrecked car Modified vehicle Extended warranty Probate Estate settlement Boat appraisals Financing Stolen vehicle Auto theft Hyundai Restomod Amelia Island Auction Nissan Cadillac Auto accident Collector car math Porsche Stolen car Ferrari Agreed value insurance RM Sotheby Monterey Ford Thunderbird Pebble Beach McLaren Mercedes Austin Car Jokes Austin Healey BringATrailer Buick Audi R8 Motorcycle appraisal Lamborghini Most Expensive Car in the World Fair Market Value Datzun 240Z Barn find Ford Bronco South Florida Bullitt Mustang 1937 Cord Bugatti Chevy Tahoe Jaguar Rebuilt title car appraisal near me Boat appraisal Fair market value appraisal Triumph TR6 Auto Appraisal Tesla Florida Recreational vehicle Miura Pinto Veyron Yugo Trabant Koenigsegg collector motorcyle Bankruptcy Rolls Royce Charity Donations Polaris Slingshot Auto loan Merry Christmas Antiquecar Classiccar fordmustangfastback motorcargallery Alfa Romeo Chevrolet Tri-Five Race car Teen driving Excalibur Phaeton Fire total loss insurance settlements Ford Pinto Chevrolet Vega AMC Gremlin JDM Japanes Domestic Market Kuruma Imports Branded title Salvage title Dodge Durango SRT Hellcat NSX Ford Mustang Shelby Hurricane Ian Flood total loss Emission standards Citroen Peugeot Renault French cars Texas Ireland Joke Registration Dirtlegal Land-Rover Defender AMC Pacer southfloridacarappraisers BMW Depreciation Auto inpector car inspector Replica Tribute Clone Recreation Kit car Ford performance Prostate cancer Alvis Mens health Movember AACA Classic car financing 1959 Ford Fairlane insurance claim Car appraiser Car adjuster Repair shop Stated Value AppraisalClause AutoInsuranceSecret Classiccars Investments Astonmartin Volkswagen Harlequin Classic car color change Most satisfying car Least satisfying car Fridge Corrosion Beingparked Friction 5starrating Googlereviews VolvoFacebook Feed

Typically insurance companies offer 70 to 85 cents on the dollar for a total loss claim!

Typically insurance companies offer 70 to 85 cents on the dollar for a total loss claim!

Typically insurance companies offer 70 to 85 cents on the dollar for a total loss claim. Be aware of the Appraisal Clause in your policy which allows you to challenge the insurance company's offer by hiring your own independent auto appraiser. Our results show that after our appraisals, insurance companies settle for an average of 19% more than their original offer. Protect your investment! Get it appraised!

Navigating Bankruptcy with Vehicle Valuation

Navigating Bankruptcy with Vehicle Valuation

Bankruptcy offers a path to regaining financial stability and starting anew. Yet, having recent bankruptcy on your record can complicate securing a loan for a new vehicle purchase. Keeping your current vehicle during this process often presents a simpler solution.

How to find an honest car dealership and repair shop

How to find an honest car dealership and repair shop

We’ve all been there. Remember the day you dove headfirst into buying your first classic ride? The one that still makes your heart race thinking about it. You stopped at the local auto parts store and purchased the most refined car wash soap and wax to lather and polish your new (to you) baby. Squarely parking your treasure in the driveway, you dragged out the hose and bucket, proudly getting to work.

2025 Ford Mustang GTD announced

2025 Ford Mustang GTD announced

The 2025 Ford Mustang GTD is the most audacious and advanced Mustang ever, a limited-edition, street legal performance car designed in parallel with Mustang GT3 race car and ready to take on the world’s best performance cars.

Car appraisals from Key West to Port Canaveral

Car appraisals from Key West to Port Canaveral

For cars, trucks, motorcycles, motorhomes, RVs, boats and light aircraft appraisals, from Key West to Port Canaveral, South Florida Car Appraisers has you covered.

15 year old BMW 650 has over $5,000 in Diminished Value

15 year old BMW 650 has over $5,000 in Diminished Value

This 15 year old BMW 650 was in an accident caused by another, resulting in over $10k in damage repairs. Following a Diminished Value appraisal, the owner is now making a $5,000 claim against the insurance company of the at-fault driver.

Which auto pre-purchase inspection should you choose?

Which auto pre-purchase inspection should you choose?

If you do an internet search for ‘auto pre-purchase inspection’ almost certainly the first Sponsored listing will be Lemon Squad. Lemon Squad has great marketing! Dig a little deeper and search for Lemon Squad reviews and you might decide to keep searching. Whichever auto pre-purchase inspection company grabs your attention, before you hire them, do your due-diligence by reading through all the good, the bad and the ugly reviews online.

Which Land Rover Defender 110 would you buy?

Which Land Rover Defender 110 would you buy?

Which Land Rover Defender 110 would you buy? Recently a client from Texas called to say he was looking to buy one of two mid-1990s advertised for sale in Miami, and he wanted pre-purchase inspections (PPI) on both so that he could decide if and which one to purchase. They were both being offered at about the same price.

Financing old cars

Financing old cars

Buying an older car has its advantages, and the purchase process is relatively easy. As simple as it is, however, it's not unusual for drivers to have questions, especially when it comes to financing. In fact, one of the most common inquiries drivers have about buying a pre-owned vehicle is, "can you finance a car older than 10 years?"

How do you get financing on your branded or rebuilt title?

How do you get financing on your branded or rebuilt title?

OK, the first question to address is what is the difference between a branded, salvage and rebuilt, or reconstructed title? A ‘branded’ title is any title that is not a ‘clean’ title. Both salvage and rebuilt/reconstructed titles are branded, but there is a difference between salvage and rebuilt. Can you get a loan on a vehicle with a salvage/rebuilt/branded title?