Blog

Common Car Insurance Scams -- And How You Can Avoid Them

Common Car Insurance Scams -- And How You Can Avoid Them

Even if you've never been involved in a car insurance scam, rest assured that you have felt their effects in the form of higher premiums. There is no national authority that keeps track of all types of auto insurance scams, but reports from various sources indicate the phenomena can cost insurance companies upwards of $6 billion per year and may account for up to 15 percent of all claims filed. Having to pay these claims results in higher premiums for policy holders, including you and me.

So your car has been totaled: FAQs

So your car has been totaled: FAQs

Q: Can I keep my car if the insurance company totals it? A: Yes. After it's been declared a total loss, you have the option to keep the car. The insurance company will subtract the salvage value from the car's market value. The salvage value is the amount a salvage yard will pay for the damaged car. If you keep the car, it will have a salvage title. If it is successfully repaired or rebuilt, you can apply to transfer the salvage title to a rebuilt title. Caution! A vehicle with a rebuilt title can be difficult and/or expensive to insure. Do your homework!

Beware of Initial Insurance Claim Settlement Offers!

Beware of Initial Insurance Claim Settlement Offers!

If you have submitted an insurance claim and feel the offer to replace your vehicle is inadequate, you’re probably right! Of all the Insurance offers we evaluate, there are only a few companies which make a reasonable offer and we can tell clients “you’re getting a decent offer.” It may be on the lower end of what the car is worth, but the cost of an appraisal isn't going to generate a sufficient return on investment.

Charitable Donation Appraisal

Charitable Donation Appraisal

If you’re looking for an appraisal for the purpose of donating a vehicle to a charitable organization, here is something you need to consider: For how much can you actually sell the vehicle?

Pre Purchase Vehicle Inspections

Pre Purchase Vehicle Inspections

Not too many years ago, if a buyer was looking for a certain type of vehicle and found one advertised more than an hour's drive away, that person probably didn't buy it! Today, however, with the evolution of companies like eBay, BringATrailer, Facebook Market Place and other specialty sites, things have really changed!

Auto Insurance - The Appraisal Clause Process. 1st party claims with your own insurance company

Auto Insurance - The Appraisal Clause Process. 1st party claims with your own insurance company

An appraisal clause is a clause or paragraph found in most, but not all, insurance policies. It is designed to be a way of reaching a settlement when there is a dispute over the amount of a loss between you and your insurance company and can be invoked by either party. The appraisal clause can be utilized when there is a dispute over the value of your vehicle in a total loss claim. The appraisal clause is generally found in the "Damage to A Vehicle" section of your policy. Following are the basic steps to invoke the appraisal clause of most policies.

Investors’ Paradise - The star of the show isn't what you think, by Jonathan Michaels

Investors’ Paradise - The star of the show isn't what you think, by Jonathan Michaels

If one were to take a guess as to the strongest asset class for investment, considerations such as fine art, rare wine or bluechip stocks might come to mind. Investment banking powerhouses across the country have long had client portfolios chocked-full of traditional- based instruments, all confident that the strategies will yield handsome returns. Yet, the starlet of the investment stage is not precious stones, rare coins or even Big Board stocks - it is a heroine of a different breed, and one that might surprise many: classic cars.

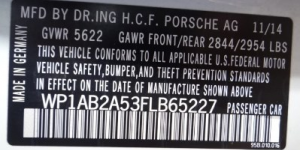

VIN, Cowl Tag, Fender Tag, Door Tag and Engine number Deciphering

VIN, Cowl Tag, Fender Tag, Door Tag and Engine number Deciphering

Your modern, classic or custom car serial number or VIN (Vehicle Identification Number) is more than an arbitrary number assigned to your car to make it unique. This serial number or VIN is packed with encoded information about your car’s drivetrain, body style and manufacturing information.

Diminished Value: The Secret the Auto Insurance Industry Doesn’t Want You to Know

Diminished Value: The Secret the Auto Insurance Industry Doesn’t Want You to Know

We’re all familiar with Depreciation, right? It’s the gradual loss of value over a given time. So what’s Diminished Value? Let’s look at this scenario. Imagine that you are stationary at a stop light or sign and suddenly a negligent driver rear-ends your vehicle. Your vehicle has just suffered Diminished Value (also known as inherent diminished value or diminution of value).

How to Determine the Age of your Tires

How to Determine the Age of your Tires

Have you ever asked yourself, “How old are my tires?” If not, you should! Determining your tire age is very important to you and your family’s safety. If you’re driving with a tire over six years old, you could be putting yourself in danger, as tires dry rot with age from the inside out.